The future has a habit of creeping up on us faster than we think. A large part of investment planning focuses on retirement, but there are investments we make for income and growth ahead of retirement. Balancing your investments for the short, medium, and long term takes careful planning. We take a holistic approach to investment planning taking every aspect of your future plans into consideration.

When it comes to investment strategies there is no ‘one size fits all’ approach. Your plan needs to be as individual as you are. Carefully curated to realise your financial goals, we will create a plan that works for right now and down the line.

St. James’s Place offers a wide range of investment solutions using risk-rated Model Portfolios which allow you to spread your investments. You can decide which asset types and fund managers to use in order to create a balanced, diversified investment plan.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you initially invested.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief depends on individual circumstances.

Individual Savings Accounts (ISA)

ISAs are one of the most popular, and tax efficient, ways to save. The ISA allowance for the tax year 2022/2023 is £20,000 with complete flexibility on how you utilise your ISA savings within that limit.

We have some of the world’s best fund managers overseeing our ISA funds who will help you develop a diversified portfolio tailored to your needs and risk resilience. We regularly review our funds, tweaking your portfolio to ensure your funds are maximised and align with market conditions.

Key Investor Information Documents

If you are looking to invest in a Unit Trust via an ISA, it's wise to read our Key Investor Information Documents and Supplementary Information Document.

The value of an investment with St. James's Place will be directly linked to the performance of funds you select, and the value can therefore go down as well as up. You may get back less than you initially invested.

An investment in a Stocks and Shares ISA will not provide the same security of capital associated with a cash ISA.

The favourable tax treatment currently given to ISAs is subject to changes in legislation and may not be maintained in the future.

Cash ISAs are not available through SJP.

Junior ISA

Growing up in the 21st Century brings with it challenges that boomers and Gen X people did not have to face. The cost of living, university fees, and the high price of home ownership mean that younger generations will need to work longer in order to save for retirement.

In 2011 Junior ISAs replaced Child Trust Funds (CTF). Children born between 2002 and 2011 might have had a CTF. You can transfer a CTF into a Junior ISA.

Setting up an ISA for your children not only starts the process of building a nest egg for them, but it also helps them develop their financial literacy which is key to their long-term financial health. They won’t be able to touch the funds until after their 18th birthday at which time they could use it for education or reinvest it to save for their future.

Key Investor Information Documents

If you are looking to invest in a Unit Trust via an ISA, it's wise to read our Key Investor Information Documents and Supplementary Information Document.

The value of an investment with St. James's Place will be directly linked to the performance of funds you select, and the value can therefore go down as well as up. You may get back less than you initially invested.

The favourable tax treatment currently given to ISAs is subject to changes in legislation and may not be maintained in the future.

Unit Trusts

Unit Trusts comprise a portfolio of different financial assets that are managed by a fund manager. A Trust can include stocks, property, bonds as well as ISAs.

Unit Trusts benefit from similar tax advantages as ISAs but they also enable you to expand your portfolio to include stock market investments without being hit by Income or Capital Gains Tax.

A well-developed tax planning strategy will often include Unit Trusts as they can provide capital growth and income in the medium to long term maximising annual tax allowances.

You can also use Unit Trusts alongside a standard Trust* if you are investing on behalf of your children.

Key Investor Information Documents

Before you choose to invest in a Unit Trust via an ISA, it’s important you read our Key Investor Information Documents and Supplementary Information Document.

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select which means that the value can go down as well as up. You may get back less than you initially invested.

The levels and bases of taxation and reliefs from taxation can change at any time and are generally dependent on individual circumstances.

* Trusts are not regulated by the Financial Conduct Authority.

Discretionary and Stockbroking Services

When you have very specific investment requirements, or you want to delegate the management of your investments, SJP’s discretionary and stockbroking services are ideal. Your SJP adviser and a dedicated investment manager from Rowan Dartington (who is wholly owned by SJP) work together to create a highly individualised service.

SJP’s discretionary portfolios give you access to a wide range of assets for investment, including direct equities. Options include:

Whether you need advice only, delegated management, or a straightforward dealing service, our team of specialists can help. Both our discretionary and stockbroking services allow you to bring across assets you might already hold with other providers, including cherished holdings. It gives you the convenience of having all your assets in one place, coupled with a more personalised and dedicated approach to maintaining your portfolio.

The value of an investment with Rowan Dartington may fall as well as rise. You may get back less than the amount invested.

*Please note that this type of investment will not be suitable for everyone. These are higher risk than mainstream investments and are therefore suitable for experienced investors who accept that they may get back significantly less than the original amount invested.

The levels and bases of taxation and reliefs from taxation can change at any time and are dependent on individual circumstances.

Investing for income

After several global financial crisis’, investors have been looking to invest in different areas for their long-term assets.

With inflation subject to frequent changes, money held in savings accounts has been hit particularly hard, which is why it’s incredibly important to diversify your income generating investments.

Interest rates have remained low for nearly a decade, and this has created alternative sources of income. Which includes:

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount initially invested.

Equities do not provide the security of capital associated with a deposit account with a bank or building society.

Past performance is not a guide to future performance.

The value of property is a matter of the valuer's opinion and not fact.

Offshore Investments

There are a multitude of reasons why creating an offshore investment portfolio makes sense. If you’re a parent wanting to provide capital for a child under 18, maybe you’re expecting your tax rate to fall, or you’re planning to live outside of the UK. If you’re entitled to an age-related allowance, or expatriates investing while non-resident, an offshore investment is a good option.

Our offshore solutions, are designed for investors who invest regularly, or as a one-off lump sum.

Offshore investments will allow you to:

This information presented is based on existing legislation and HM Revenue & Customs practice. It does not amount to tax planning advice. Any potential investor who is unsure of their tax position is recommended to take advice before investing.

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select, and the value could therefore go down as well as up. You may get back less than you initially invested.

Currency movements may also affect the value of investments.

The levels and bases of taxation and reliefs from taxation can change at any time and are dependent on individual circumstances.

Growth and Income Portfolios

Deciding where to invest your money can be overwhelming. To help you choose investments that are appropriate to you, SJP has created risk-related Growth and Income Portfolios.

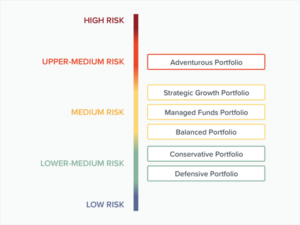

Growth Portfolios

Designed to help you build the value of your wealth through capital growth over the medium to long term.

They work for a number of different circumstances, but are most commonly used to build up pension pots and college funds.

There are five main types of growth portfolio, all based on differing levels of risk. Typically, the higher the risk, the greater the return.

Developing the right mix of investments for you and your family is critical in order to protect (and grow) your retirement fund. Our advisers will help you create a tailored portfolio that matches your financial goals and comfort zone.

There are five Growth Portfolios, with differing levels of risk.

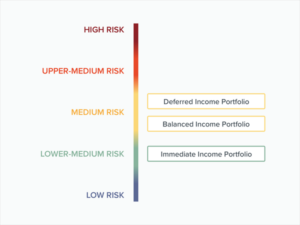

Income Portfolios

This type of portfolio is designed to generate an attractive, and sustainable, level of income. These work well if you’re looking to generate extra income for retirement. As with growth portfolios, these funds are risk rated allowing you to flex as your financial plan matures ensuring you maximise the return on your investments. There are three main types of income portfolios.

Your SJP adviser will help you create the right income portfolio for you.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Having invested with SJP with the help of Jayna Shah – Director (Brighton Office) – I have nothing but praise for the diligence, and care, she affords her prospective and current clients. Her understanding of the products in relation to client needs, along with the support, are ‘second to none’. I more than highly recommend JPS to anyone.

Jayna Shah is an exceptionally devoted consultant who goes the extra mile. The Directors at Hunters have no hesitation in recommending Jayna's services to anyone searching for carefully considered pensions and investments advice. What sets Jayna apart is that she is very patient, personable and helpful. The very definition of a 5 Star service.

Jayna is a professional. Clearly at the top of her game. Her work transferring my pension was exceptional!

Jayna clearly explains all the complex aspects of retirement funding. She is patient and does not rush me to make decisions, showing me the pros and cons of various options. I am very happy with the advice and service provided by Jayna and would happily recommend her to others.

Jayna has been very helpful & professional. She provided excellent pension advice to me. I would certainly recommend her to others.

Jayna is both friendly and approachable, professional and knowledgeable. It has been a pleasure to do business with her.

Jayna's advice when it comes to both my pension and finances has always been second to none. I would recommend her services. My wife has also just started a pension and is also very impressed.

The Partner Practice is an Appointed Representative of and represents only St. James’s Place Wealth Management plc (which is authorised and regulated by the Financial Conduct Authority) for the purpose of advising solely on the Group’s wealth management products and services, more details of which are set out on the Group’s website www.sjp.co.uk/products. The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives.

JPS Wealth Management Ltd is registered in England and Wales, Number 09274545. Registered Office: 14a Montpelier Place, Brighton, BN1 3BF.